Chart Patterns Cheat Sheet

Master the most powerful chart patterns in trading — from classic reversals like Head & Shoulders to high-probability continuations like Flags and Pennants. This cheat sheet breaks down each pattern’s structure, psychology, entry trigger, and how best to use them.

While no pattern works 100% of the time, they become far more effective when used with trend filters, volume confirmation, and other indicators. I prefer bullish setups — especially Inverted Head & Shoulders, Double Bottoms, and the Bullish Falling Wedge — as there is more upside with long trades.

How to add patterns to your TradingView chart:

- 1. Open tradingview.com and select your desired asset.

- 2. Click on the Indicators icon at the top.

- 3. Search for: Head and Shoulders, Double Top, or any other pattern

- 4. Click to add, and adjust settings as needed.

5. Scroll through the chart history to see the patterns on the chart. Review at least 30 and see how many times they hit the target and how many times they fail, and decide which ones you ant to master.

Reversal Patterns

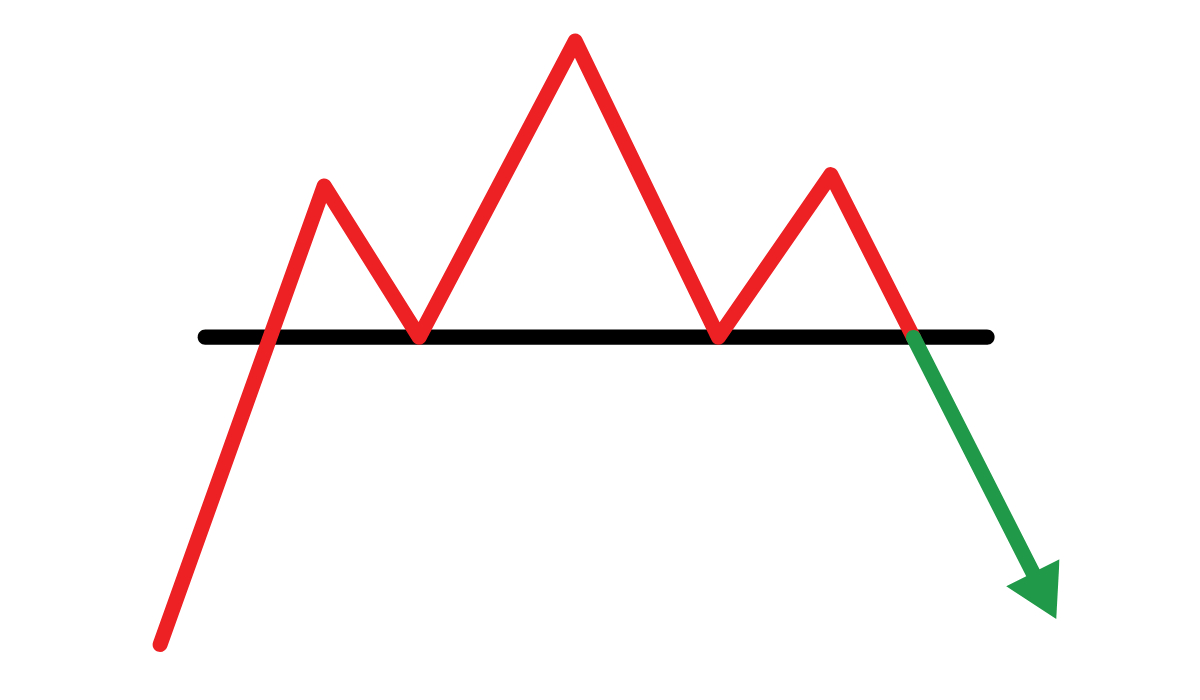

Head & Shoulders

Signals a trend reversal from bullish to bearish.

Psychology Behind It: Buyers are losing strength as each high becomes weaker, ending in a breakout below the neckline.

Entry Trigger: Breakdown below the neckline

Stop Loss Placement: Above the right shoulder

Profit Target: Distance from head to neckline projected downward

Works Best In: Uptrend

Reliability: High

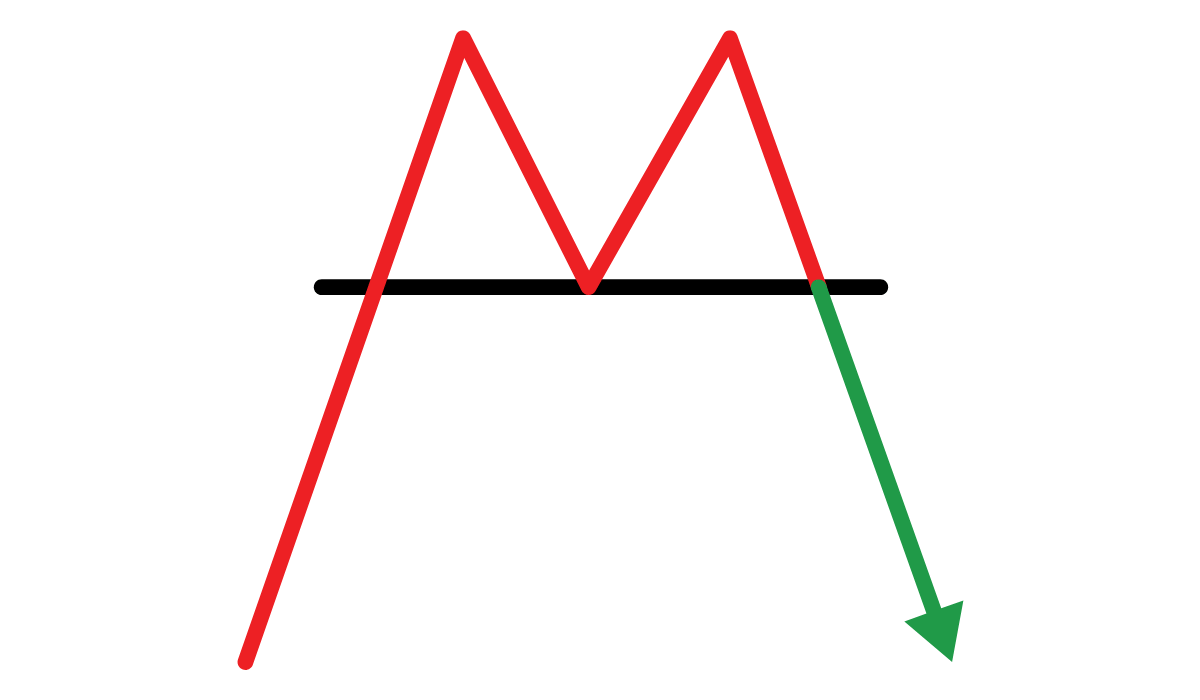

Double Top

A bearish reversal pattern after an uptrend.

Psychology Behind It: Price hits resistance twice and fails to break higher, suggesting a shift to bearish control.

Entry Trigger: Break below the neckline

Stop Loss Placement: Above the second top

Profit Target: Distance from tops to neckline projected downward

Works Best In: Uptrend

Reliability: High

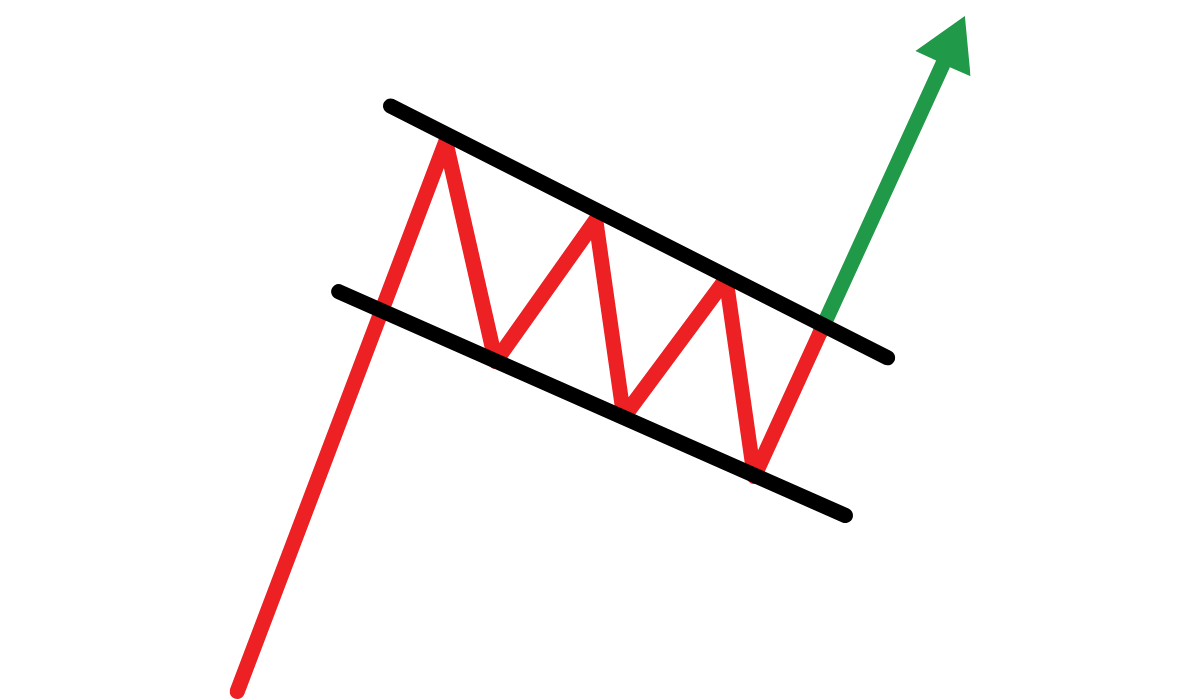

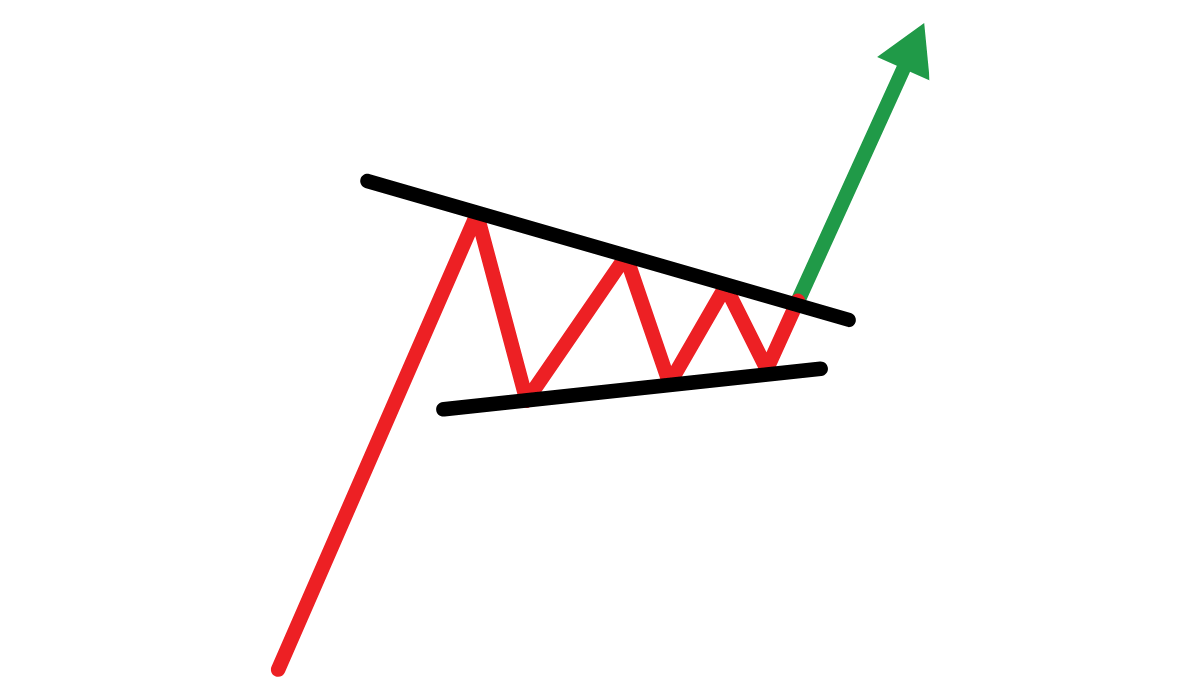

Bullish Falling Wedge

A bullish reversal pattern formed by two converging downward-sloping trendlines.

Psychology Behind It: Selling pressure weakens as price contracts; a breakout suggests buyers are regaining control.

Entry Trigger: Breakout above the upper trendline

Stop Loss Placement: Below the lowest point of the wedge

Profit Target: Height of the wedge projected upward from breakout

Works Best In: Downtrend

Reliability: Medium

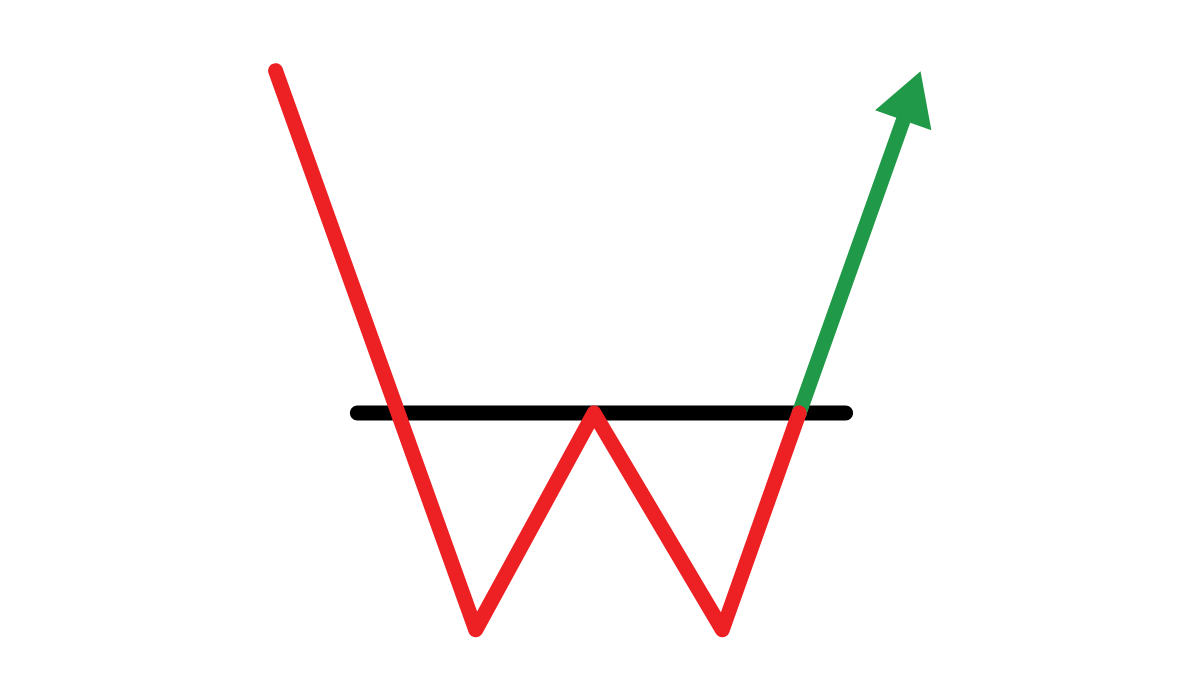

Inverted Head & Shoulders

Bullish reversal pattern signaling a trend shift upward.

Psychology Behind It: Sellers lose momentum, forming a base, then buyers break out above the neckline.

Entry Trigger: Breakout above the neckline

Stop Loss Placement: Below the right shoulder

Profit Target: Distance from head to neckline projected upward

Works Best In: Downtrend

Reliability: High

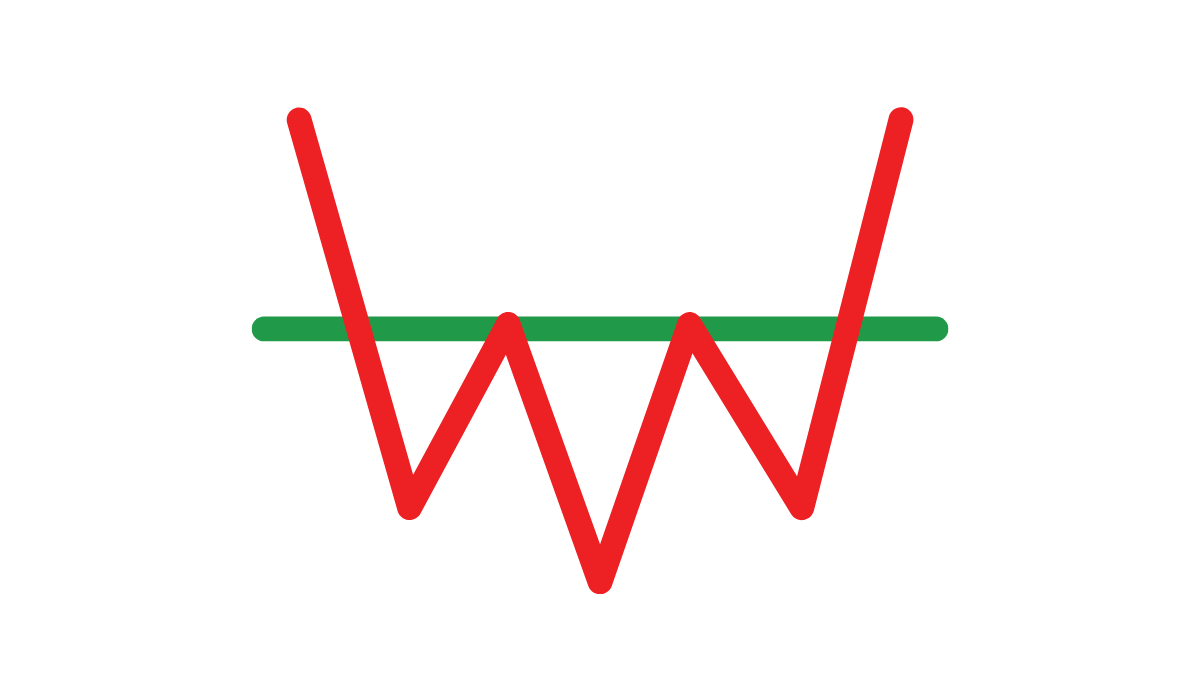

Double Bottom

Bullish reversal pattern after a downtrend.

Psychology Behind It: Price finds support twice and breaks higher, indicating buyer strength.

Entry Trigger: Break above the neckline

Stop Loss Placement: Below the second bottom

Profit Target: Height of pattern projected upward

Works Best In: Downtrend

Reliability: High

Bearish Rising Wedge

A bearish reversal pattern formed by two converging upward-sloping trendlines.

Psychology Behind It: Buyers push price higher, but momentum fades, and a breakdown signals seller strength.

Entry Trigger: Breakdown below the lower trendline

Stop Loss Placement: Above the highest point of the wedge

Profit Target: Height of the wedge projected downward from breakdown

Works Best In: Uptrend

Reliability: Medium

Continuation Patterns

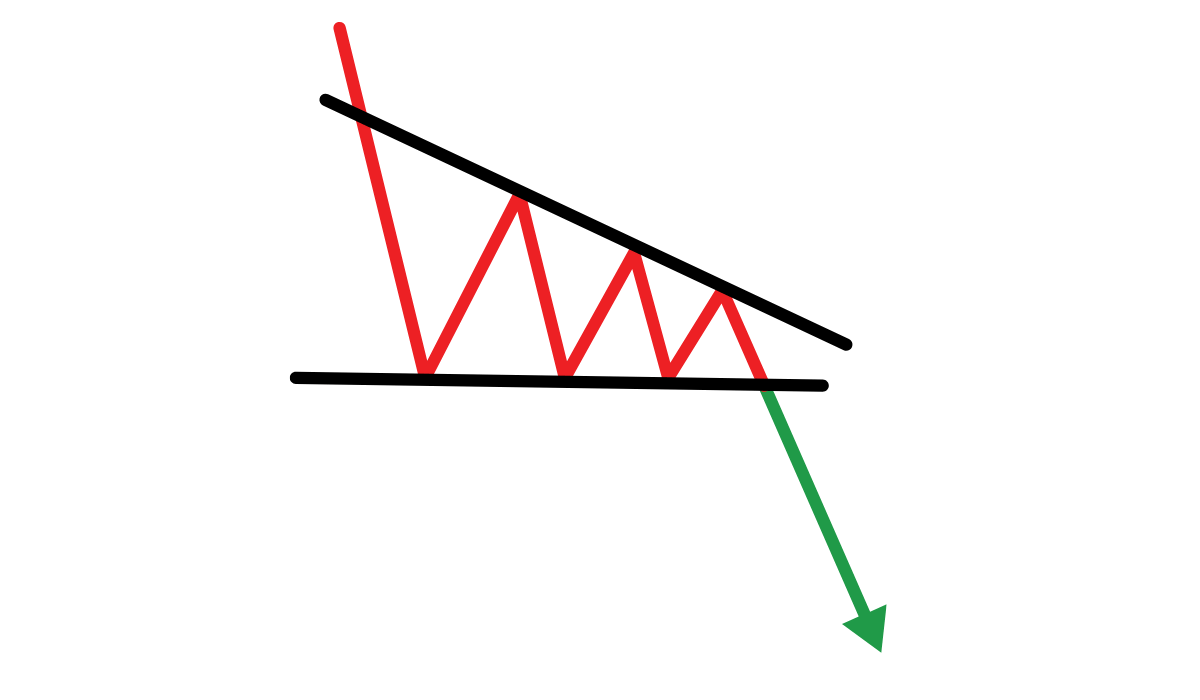

Descending Triangle

Bearish continuation pattern showing lower highs with flat support.

Psychology Behind It: Sellers are gaining control and pressuring support levels repeatedly.

Entry Trigger: Breakdown below the flat base

Stop Loss Placement: Above the most recent lower high

Profit Target: Height of triangle projected downward

Works Best In: Downtrend

Reliability: High

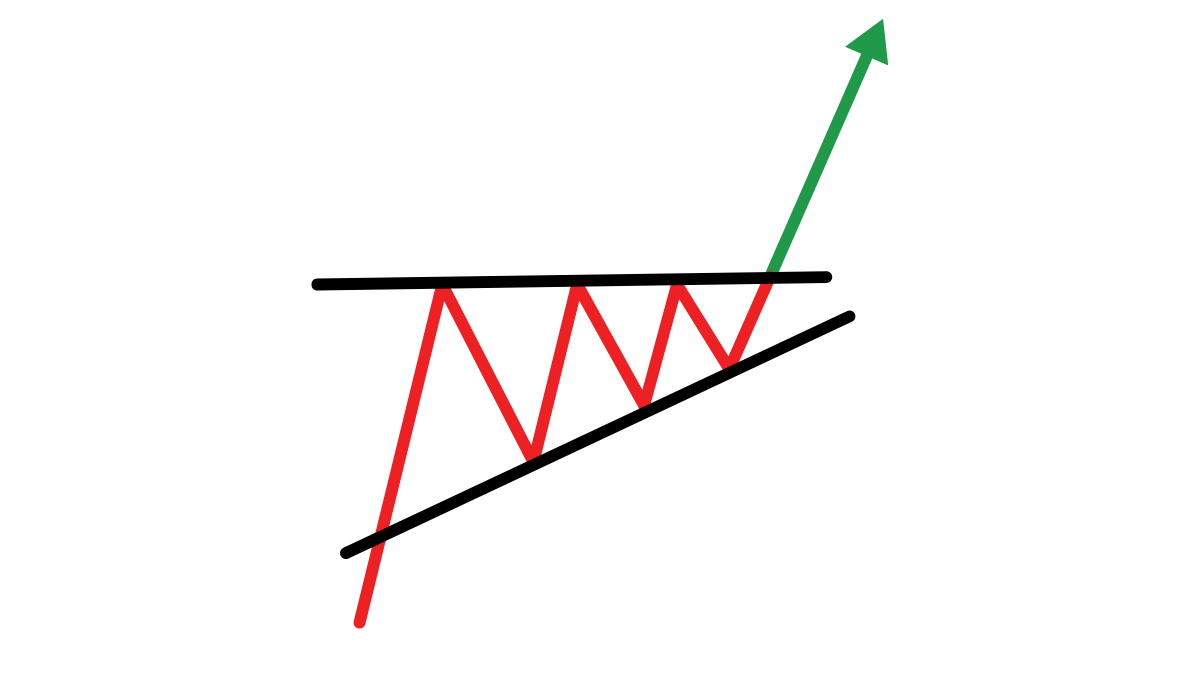

Ascending Triangle

Bullish continuation with flat resistance and rising support.

Psychology Behind It: Buyers are increasingly aggressive, squeezing the price toward a breakout.

Entry Trigger: Breakout above the horizontal resistance

Stop Loss Placement: Below the latest higher low

Profit Target: Height of triangle projected upward

Works Best In: Uptrend

Reliability: High

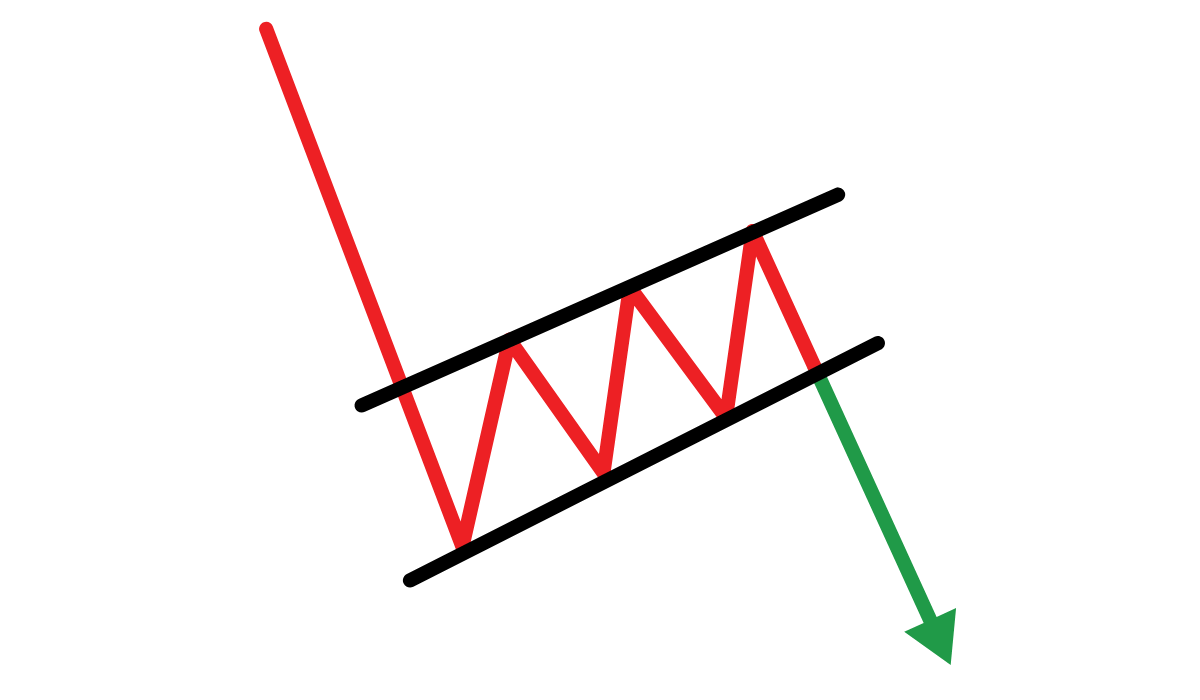

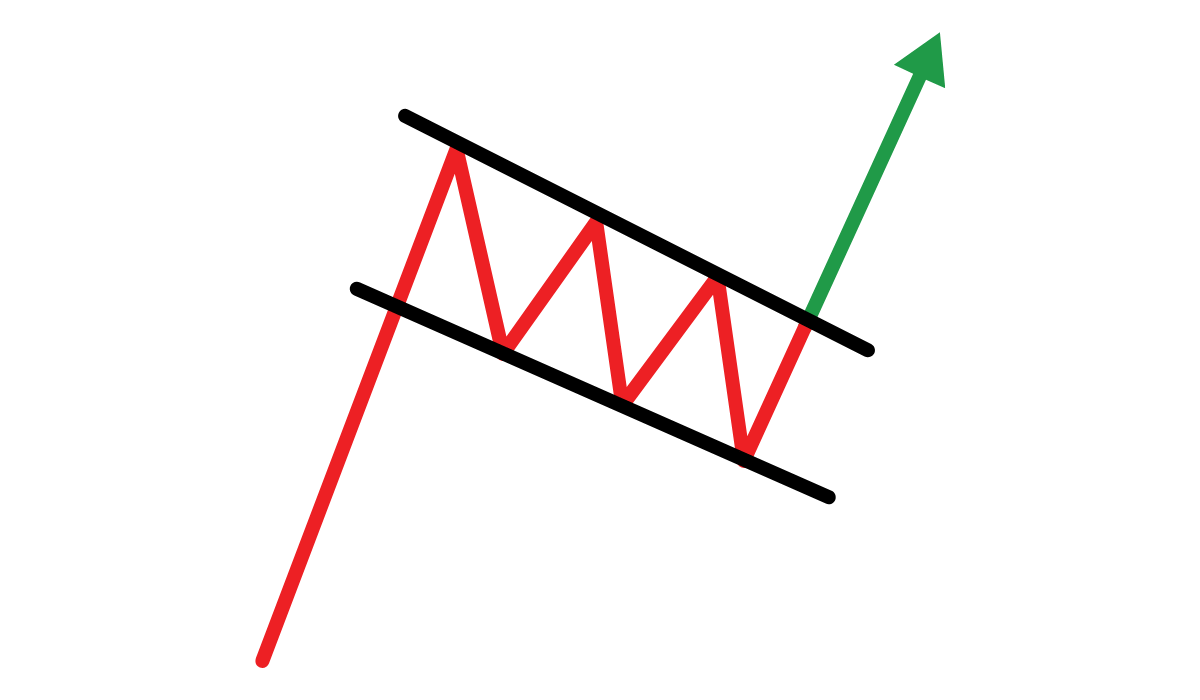

Flags

Short-term consolidation following a sharp price move.

Psychology Behind It: A pause in momentum that allows price to regroup before continuing in the same direction.

Entry Trigger: Breakout in direction of flagpole

Stop Loss Placement: Below opposite side of the flag

Profit Target: Flagpole height projected from breakout

Works Best In: Strong trends

Reliability: High

Pennants

Brief consolidation shaped like a small symmetrical triangle.

Psychology Behind It: Price contracts in a tight range before continuing the initial trend.

Entry Trigger: Breakout in direction of prior move

Stop Loss Placement: Below/above the pennant depending on direction

Profit Target: Pole height projected from breakout

Works Best In: Strong trends

Reliability: High

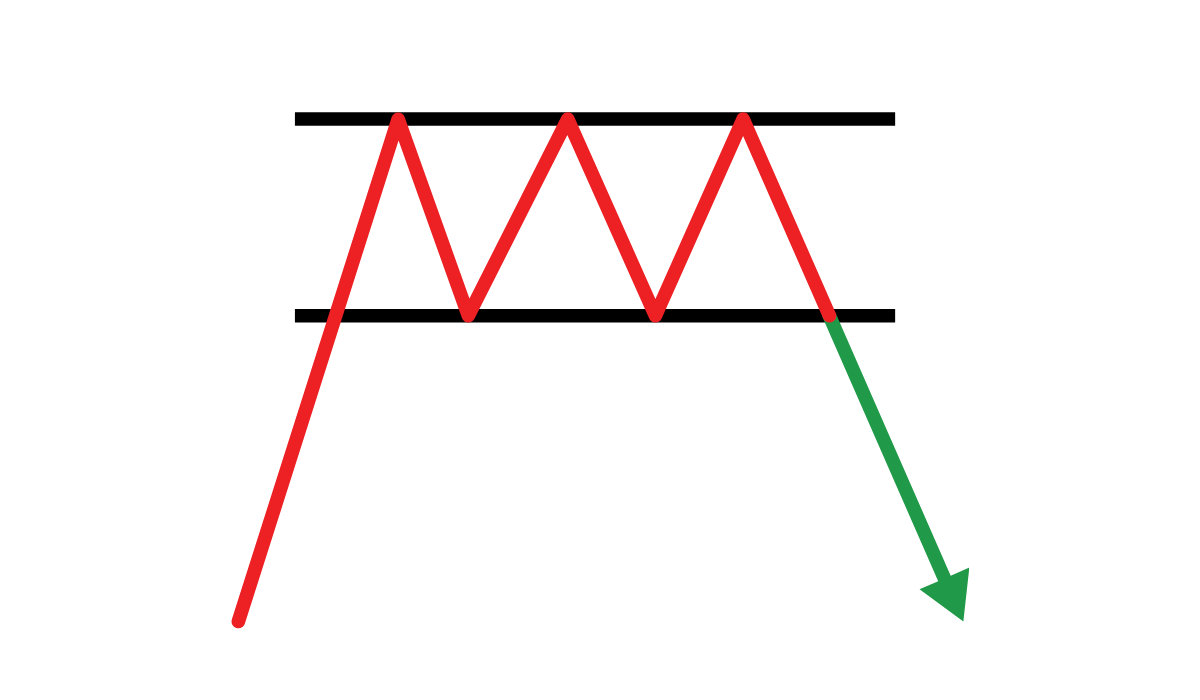

Rectangle

Price bounces between clear support and resistance.

Psychology Behind It: Indecision in the market before breakout resumes trend.

Entry Trigger: Breakout from the range

Stop Loss Placement: Opposite side of the range

Profit Target: Height of range projected from breakout

Works Best In: Trending markets

Reliability: Medium

Neutral Patterns

Symmetrical Triangle

Converging trendlines with no directional bias.

Psychology Behind It: Price compresses as buyers and sellers reach a standoff before a breakout.

Entry Trigger: Breakout in either direction

Stop Loss Placement: Outside the triangle

Profit Target: Height of triangle projected from breakout

Works Best In: Volatile or uncertain trends

Reliability: Medium